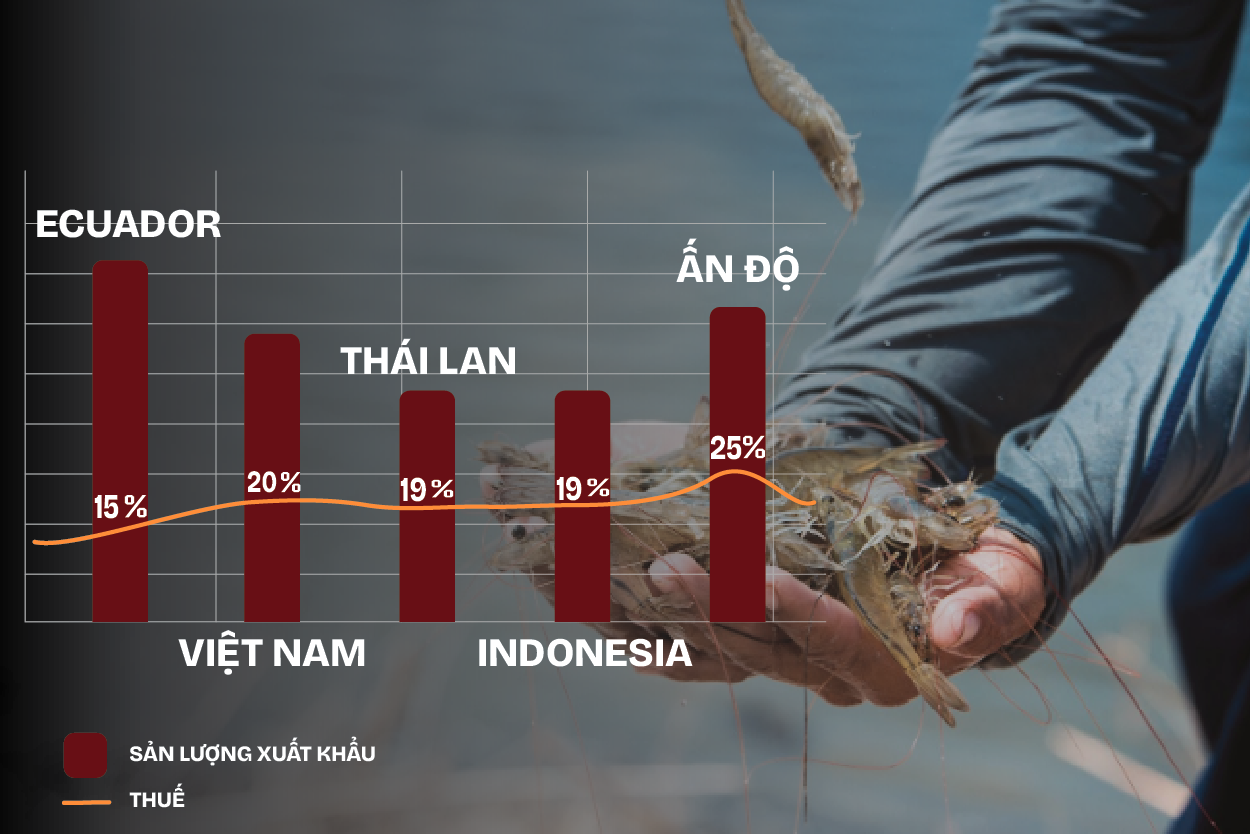

In the shrimp industry, global, Ecuador's national export shrimp on top of the world, India ranks 2 and Vietnam, 3rd, Thailand and Indonesia in turn stand in position 4 th, 5 th. America has announced tax reciprocal for Vietnam is 20%, India 25%, Ecuador By 15%, Thailand and Indonesia under the same tax rate 19%. Forecast the race of the “big shrimp industry” in the coming time there will be fluctuations big...

According to the Association Processing and Exporting Vietnam seafood (VASEP), in the first half of 2025, shrimp exports to Vietnam reached more than 2 billion USD, an increase of 27% compared to the same period 2024. In it, white shrimp accounted for the highest with 62,1%, prawn (10,5%) and the type of other shrimp (27,4%).

Export markets shrimp first half of the year 2025

In the first half of 2025, China and Hong Kong have risen to the no. 1 position with a turnover of close to 595 million, a sharp increase of 81% compared to the same period. The recovery in consumer demand for high summer and the high demand for lobster from Vietnam continue to help China become a market, the most breaking.

Group market CPTPP also recorded positive results with a growth of 38%. In which, Japanese, increased by 19%, Australia 5% increase and Canada increased by 6%.

The EU market increased by 16% in that strong growth in the markets of Germany, Belgium and France. This number is expected to grow larger again, thanks to benefit from the Agreement EVFTA, while rivals such as Thailand, Indonesia no.

In the first 6 months of the year 2025, the Korean market growth of 14%, thanks to steady demand and popular shrimp processing skills.

Shrimp Vietnamese on American soil

On the contrary, the U.s. market – each as a leading exporter of shrimp, Vietnam to the signs of decline markedly. Though the total turnover of 6 months to reach 341 million, an increase of 13% compared with the same period year ago, but happenings by month trend shows teen upbeat: months 05/2025 soared 66% compared to the same period due to business, enlist goods before tax pressure; to months 06/2025 plummeted 37% compared with January 06/2024.

According to VASEP, the shrimp market global are witnessing the large fluctuations of tax reciprocal in the Us. Tariffs for applications that American pressure on Vietnam to be published is 20%. Along with that is the risk from tariffs, anti-dumping (AD) preliminary up to 35% and will also have taxes anti-subsidy (CVD) estimates the Us will publish the end of the year.

In the shrimp industry, global, Ecuador's national export shrimp on top of the world, India stands 2nd, Vietnam ranked 3rd, Thailand and Indonesia in turn stand in position, 4th, 5th. America has announced tax reciprocal for Vietnam is 20%, India – 25%, Ecuador By 15%, Thailand and Indonesia under the same tax rate 19%. Clearly, the competition with shrimp Ecuador increasingly more difficult for Vietnam.

Moving from market America – Way for shrimp Vietnamese?

According to VASEP, in the context of the administration Trump imposed a high tax for imports from the Asian countries, the shrimp industry has quickly search for new markets to reduce dependence on the United States. Although, this market is big but white shrimp account for only about 20% of the total global consumption.

To maintain growth and reduce risk, businesses need to re-structure export strategy towards diversification of markets and products, enhance the value increase. Taking advantage of the trade agreements freedom as the EVFTA, CPTPP, RCEP... will open the opportunity to penetrate deeper into the market, such as Europe, Japan, south Korea.

“Shrimp market global current like a river is changing flow. Instead of just focusing on a few big markets such as the United States, the consumption market is expanding into many areas, such as EU, Japan, and all the local markets in producing countries such as Vietnam. The shift not only does this help reduce risk but also create more opportunities and new growth for the shrimp industry worldwide”, VASEP stressed.

Besides, optimal production costs, improve efficiency, feed solution is key to shrimp industry sustainable development. Food accounted for the largest proportion of the total cost, so the formulation suitable for each stage of development of shrimp not only promote growth, but also reduce costs, improve feed conversion ratio (FCR) and limit the negative impact on the pond environment.

Shrimp digestive system adapts well to the protein; therefore, food should ensure high protein content, does not contain fiber, starch, or the anti-nutritional factors that hinders digestion. In the current trend, Protein single cell striking as a raw material feed fully meet these criteria, at the same time has reasonable price, help to significantly save costs without sacrificing performance cultivating high.

In summary, to shrimp industry sustainable development in addition to quality control, strict need to optimize production, product diversification and market gradually penetrate deep into the many potential markets, positioning, the shrimp industry in Vietnam.

Learn more about the optimal solution – modern to balance the ration nutrients on aquatic products, you can refer to. PROTEIN SINGLE-CELL AJITEIN – Raw material supply protein food, easy to digest, originated as single-celled microorganism